MacDonald Highlands Real Estate: Why 127 Days on Market Creates Unprecedented Luxury Buyer Leverage

By Billy O’Keefe, Henderson Luxury Realtor & Las Vegas Real Estate Expert

Let’s cut through the luxury market hype. MacDonald Highlands homes are taking 127 days to sell – a 67% increase from last year’s 76 days. Every single recent sale closed below asking price. The median list price of $4.1 million collides with median sale prices ranging $1.5M-$2.7M depending on property type, creating a significant perception gap.

For buyers who understand what these numbers mean, this is your moment.

The Numbers That Define MacDonald Highlands Right Now

Based on current market data as of November 2025:

- 127 days average market time (up from 76 days in 2024) – This isn’t weakness, it’s selectivity. Luxury buyers at the $2-5 million price point are conducting extended due diligence, comparing multiple properties, and negotiating terms that simply weren’t available 18 months ago.

- 100% of recent sales closed below asking price – Fundamental market reset from the 2021-2023 environment where multiple offers and above-asking sales were standard. Properties priced within 10% of recent comps move in 60-90 days. Those priced at peak market aspirations accumulate months of market time.

- Median sale prices ranging $1.5M-$2.7M depending on property type – MacDonald Highlands encompasses everything from luxury townhomes starting around $800K to ultra-luxury custom estates exceeding $5 million. The “median” varies depending on whether data includes all property types or only single-family homes. What matters more: the gap between $4.1M median list price and actual closing prices reveals current negotiation dynamics.

- Record-breaking $25.25 million sale – While headlines focus on this extraordinary transaction (5,800 sq ft penthouse at the Four Seasons Private Residences), the practical reality for most buyers is that inventory under $3 million provides exceptional leverage in today’s environment.

This is what experienced luxury buyers recognize as a classic transition market – the brief window between seller capitulation and the next wave of competitive demand.

Why California Buyers Still Dominate MacDonald Highlands Despite Market Slowdown

60% of MacDonald Highlands buyers are California transplants, and that percentage hasn’t dropped despite extended market times. The math remains compelling:

California’s combined state income tax rate reaches 13.3% (12.3% base rate plus 1% mental health surcharge) for high earners. Nevada’s 0% state income tax creates immediate savings of $130,000-$500,000+ annually for households with $1M-$4M+ in California taxable income. For a California executive earning $2 million annually, relocating to MacDonald Highlands generates $266,000 in annual tax savings – enough to cover a $1.2 million mortgage payment entirely through tax arbitrage alone.

The fundamental economic driver – California tax exodus – hasn’t changed. What’s changed is buyer leverage. California relocators are no longer competing against multiple offers. They’re negotiating 5-8% below asking price with seller-paid closing costs and extended inspection periods.

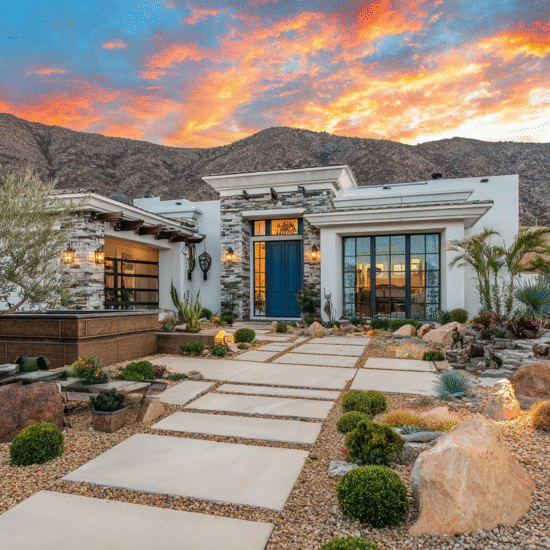

What Makes MacDonald Highlands Worth the Premium Over Summerlin and Anthem

MacDonald Highlands commands prices 40-60% above comparable Summerlin homes and 25-35% above Anthem properties. Buyers justify this premium through three irreplaceable factors:

DragonRidge Country Club exclusivity. One of only two Tom Fazio-designed courses in Las Vegas, DragonRidge provides the social infrastructure that defines luxury community living. The club’s membership structure (mandatory for certain neighborhoods, optional for others) creates a unique dynamic where access to elite amenities isn’t guaranteed by property purchase alone.

Elevation and views. Properties sit 2,000-3,000 feet above the Las Vegas Valley floor. The temperature differential (5-8 degrees cooler year-round) and unobstructed city/mountain views can’t be replicated in master-planned communities built on valley floor parcels.

Ultra-luxury inventory concentration. While Summerlin offers diverse price points from $400K to $3M+, and Skye Canyon appeals to move-up buyers at $500K-$1.2M, MacDonald Highlands serves the $2M-$15M+ market exclusively. The Four Seasons Private Residences (with units priced $2.8M-$30M+) elevates the entire community’s positioning.

The question isn’t whether MacDonald Highlands is “worth” more than Summerlin or Anthem. The question is whether the lifestyle premium – measured in social access, climate differential, and ultra-luxury neighbors – justifies the 40% price increase for your specific situation.

Practical Buyer Strategies for MacDonald Highlands in This Market

The extended market times and below-asking closures create specific opportunities that didn’t exist 18 months ago. Start your search here to identify properties that meet these criteria:

Target properties with 90+ days of market time. Once a luxury listing passes the 90-day mark, seller psychology shifts from “I’ll wait for my price” to “I need to adjust expectations.” Properties at 120-150 days often accept offers 7-10% below asking with seller concessions on closing costs or repairs.

Negotiate seller-paid rate buydowns. In a market where sellers anticipated $4M+ closures and are accepting $3.5M offers, redirecting $40K-$60K of that gap toward a 2-1 or 1-0 rate buydown often proves more palatable than another direct price reduction. At current rates around 6.4-6.6%, a 1% buydown for the first year translates to $2,500-$3,000 monthly payment reduction on a $2M mortgage.

Leverage inspection periods for re-negotiation. Extended market times make sellers more receptive to repair credits or price adjustments discovered during inspection. Properties listed 100+ days rarely walk away from a deal over $25K-$50K in requested repairs.

Focus on motivated sellers. Divorce sales, estate settlements, out-of-state relocations, and job transfers create genuine motivation that transcends market conditions. These situations often accept the first reasonable offer rather than gambling on better terms months later.

Where This Market Is Heading

The luxury real estate cycle operates on 18-24 month lag from broader market shifts. What we’re experiencing now in MacDonald Highlands mirrors what mass-market Summerlin and Henderson properties experienced in Q3-Q4 2023: the transition from seller’s market psychology to buyer leverage.

California tax policy changes remain unlikely through 2026-2027, maintaining the primary demand driver. High-net-worth individuals aren’t moving to Nevada because Las Vegas is trendy – they’re moving because $200K-$500K annual tax savings compounds into $2M-$5M+ over a decade.

The current buyer advantage window typically lasts 12-18 months before demand recalibrates to new pricing. Once California buyers recognize that $3.2M MacDonald Highlands properties are closing at $2.9M with seller concessions, competitive pressure returns. The cycle repeats.

Why Experience Matters When Navigating Luxury Transactions

I’ve closed 1,700+ transactions across 25+ years representing every Las Vegas market cycle. My background spans from the 2008 recession through the 2021 peak – patterns are clear: luxury markets don’t crash, they compress. They don’t recover overnight, they recalibrate based on fundamental value drivers.

MacDonald Highlands’ fundamental value drivers remain intact:

DragonRidge Country Club access: Tom Fazio’s only Las Vegas-area design provides an 18-hole championship course rated 72.4/138 (slope rating among Nevada’s highest). The mandatory membership structure for certain neighborhoods creates genuine exclusivity – property ownership doesn’t automatically grant club access. Social infrastructure matters at this price point; the difference between owning a $3M home with country club access versus without is measured in networking opportunities, business relationships, and lifestyle integration that can’t be replicated through daily-fee facilities.

2,000+ foot elevation with Strip/mountain views: Properties sit 2,000-3,000 feet above the Las Vegas Valley floor, creating a measurable 5-8 degree temperature differential year-round. Summer afternoons at MacDonald Highlands register 95-98°F while valley floor temperatures hit 105-108°F. The elevation provides unobstructed 180-degree views spanning the Strip, Spring Mountains, and Sunrise Mountain – sight lines impossible to achieve from Summerlin‘s valley floor developments or Henderson’s lower-elevation master plans.

California tax arbitrage economics: Nevada’s 0% state income tax versus California’s 13.3% top rate (12.3% base + 1% mental health surcharge) generates $130,000-$500,000+ annual savings for households with $1M-$4M+ California taxable income. A California executive earning $2M annually saves $266,000 per year by establishing Nevada residency – enough to cover a $1.2M mortgage payment entirely through tax savings alone. This fundamental economic driver remains unchanged regardless of market cycles.

Ultra-luxury positioning above mass-market Henderson: While Anthem serves the $500K-$1.2M market and Green Valley targets $400K-$900K buyers, MacDonald Highlands operates exclusively in the $2M-$15M+ segment. The Four Seasons Private Residences (units priced $2.8M-$30M+) elevates the entire community’s luxury positioning, creating a halo effect that benefits all properties within the gates. Understanding Henderson’s luxury market dynamics helps contextualize MacDonald Highlands’ premium positioning.

What’s changed isn’t value – it’s leverage. Buyers with cash position, pre-approved financing, and willingness to close efficiently hold negotiating advantages not seen since 2019.

After 25+ years and 1,700+ closed transactions representing every Las Vegas market cycle, I’ve earned the trust of clients precisely because I tell you what you need to hear, not what you want to hear. See what my clients say about working with me, then learn more about my approach to luxury real estate.

Billy O’Keefe

Henderson Luxury Realtor | Las Vegas Real Estate Expert

25+ Years Experience | 1,700+ Closed Transactions | 890+ Five-Star Reviews

Contact Billy O’Keefe for MacDonald Highlands real estate expertise backed by 25+ years of Henderson luxury market experience.